Are you self-employed? Do you need an instant personal loan? Then you’ve come to the right place.

MoneyGray Instant Personal Loan for Self-Employed

Get an instant personal loan for self-employed from MoneyGray within just 24 hours. Fulfill our quick eligibility criteria, submit the necessary documents, and get approved for a loan of upto Rs. 25 lakh. Continue reading to know more.

Eligibility Criteria for Instant Personal Loan for Self-Employed

Fulfill the eligibility criteria given below and get a personal loan for self-employed -

-

Applicants must have a minimum monthly income of Rs. 15,000.

-

IIncome must be credited to a bank account and must not be in cash

-

Applicants must have a minimum CIBIL score of 600 or Experian score of 650

-

Applicants must be between the ages of 18 and 55

If you fulfill the above criteria, follow the steps given below to apply -

-

1. Visit the MoneyGray website or download the app and provide the required details. Based on this, we will let you know your eligibility in just 2 minutes

-

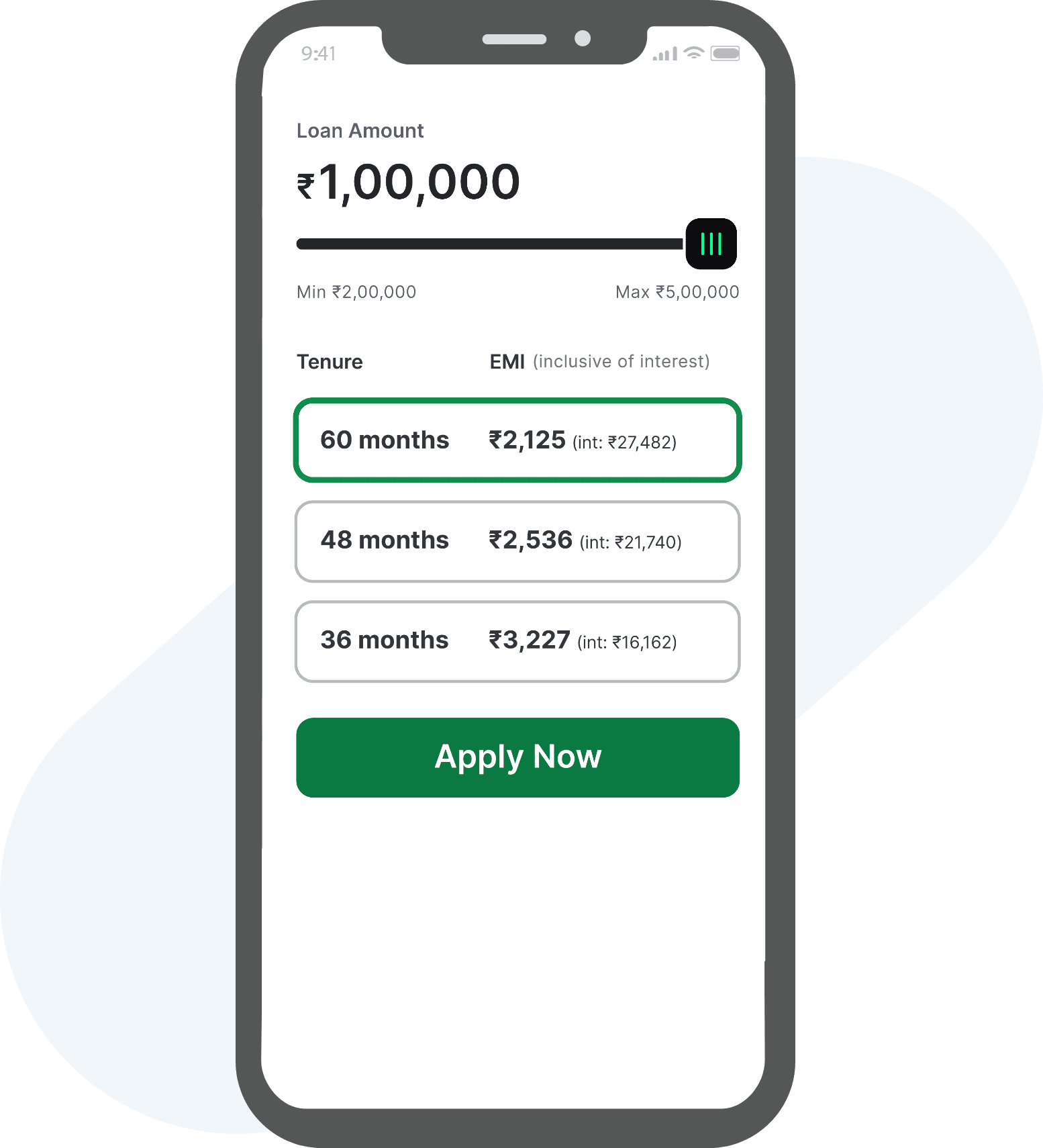

2. We will provide options for the loan amount and tenure based on your eligibility

-

3. Choose the option that works for you then upload all of the necessary documents online for verification in a hassle-free manner

-

4. After your documents are verified and loan agreement is submitted, the loan amount will be credited to your bank account within 24 hours

Note -

-

Once your documents are verified, you will receive a NACH form which needs to be printed, signed, scanned, and sent back to us

-

This step will enable the auto-debit facility from your bank account and allow you to pay your EMIs on time automatically without any manual intervention

-

On receiving your NACH form, you will need to review the loan agreement on the app. Please submit the application after reviewing all the terms and conditions thoroughly

Documents Required for Instant Personal Loan for Self-Employed

We understand the hassle of providing multiple documents. This is why we require a maximum of 3 documents from you. These are - -

| Identity Proof |

Address Proof |

Income Proof |

PAN Card - This is the primary ID proof required. However, if it is rejected due to image quality issues or other reasons, any 1 of the officially valid documents given below will suffice)

- Aadhaar Card

- Valid Indian Passport

- Valid Voter ID

- Valid Driver’s License

|

Any 1 of the following -

- Aadhaar Card

- Valid Indian Passport

- Valid Voter ID

- Valid Driver’s License

- Utility Bills (Electricity, Water, Gas) dated within the last 60 days

|

Last 3 months’ bank statements in PDF format

|

Fees and Charges for Personal Loans for Self-Employed

MoneyGray provides instant loans for self-employed borrowers at competitive rates. Take a look at the table below to know more -

| Fees and Charges |

Amount Chargeable |

| Interest Rate |

Starting from 0.75% per month |

| Loan Processing Charges |

Starts at 2% of the approved loan amount |

| Interest on Overdue EMIs |

2% per month on the overdue EMI/Principal loan amount |

| Cheque Bounce |

Rs.500/- each time |

| Loan Cancellation |

- No additional charges levied.

- The interest amount for the period between loan disbursement and loan cancellation will be payable.

- Processing fees will also be retained.

|

Conclusion

Self-employed individuals may sometimes have trouble getting a loan due to the uncertain nature of their income. However, at MoneyGray you can get instant loans that can be used for various purposes. As long as you fulfill the eligibility criteria, you can easily get a personal loan for self-employed from

MoneyGray by visiting the website or downloading the app and applying.

Self-Employed Personal Loan - Related FAQs

1. Can I Get A Personal Loan Even If My Credit Score Is Low?

Ans: Yes, you can avail a personal loan from us even if you have a low credit score thanks to our in-house credit rating model. However, you will need to have a CIBIL score of over 600 or Experian score of over 650.

2. Is Part-Prepayment Allowed On My Personal Loan?

Ans: No, we do not allow part-prepayment of personal loans. However, you can foreclose your loan after a certain number of EMIs have been made based on your repayment term as given below:

| Fees and Charges |

Amount Chargeable |

| Foreclosure Charges |

Nil but foreclosure can be done only after a minimum number of EMIs have been paid as illustrated below-

| Tenure |

Foreclosure |

| Up to 6 months |

Not allowed |

| 7 - 18 months |

Allowed after 6 EMI payments |

| Over 18 months |

Allowed after 12 EMI payments |

|

| Part- Prepayment Charges |

Part-prepayment is not allowed |

3. How Can I Track My Personal Loan Application Status?

Ans: Once you have submitted an application, you can track your application status on our app or website by following the steps below -

A. If you’ve applied on our website

- Go to the login section on the website by clicking here: /apply-loan/signup

- Login into your loan account with your registered email ID

- Go to the ‘Dashboard’ section of your loan account

- Scroll down to the ‘Application Status’ tab to know the status of your loan application

B. If you’ve applied on the MoneyGray app

- Open the MoneyGray app

- Register yourself with a valid email ID if you haven’t done it yet

- Head over to the ‘Loans’ section

- You will then be automatically redirected to the ‘Application Status’ screen where you can check your application details

- IIf you have the MoneyGray Loans app, you’ll be directed to the ‘Application Status’ screen automatically as soon as you open it

4. Will I Get A Loan If I Get My Salary In Cash?

Ans: Currently we only provide loans to those individuals who get their salary directly credited to their bank account from their employer. We will not be able to give loans to applicants who get their salaries in cash.

5. Can I Cancel The Loan At Any Stage?

Ans: A personal loan application can be canceled only before the submission of the Loan Agreement Form. Once that is submitted, you will not be in a position to cancel the loan.

6. What Happens If The App Crashes Midway Through The Application Process?

Ans: Our app has been designed to ensure a smooth experience. However, if the app does crash during the application process, please do not worry as you will be able to restart the process from the same step again.

7. What Is The Minimum Credit Score Required For A Self-Employed Personal Loan From MoneyGray?

Ans: At MoneyGray, we use a unique credit rating model that takes multiple factors into account. This is why even if your credit score is low, you can still get a personal loan from us. However, we will require applicants to have a minimum CIBIL score of 600 or Experian score of 650.

8. Can I Get An Instant Loan Without Salary Slip, ITR, And Bank Statement?

Ans: You can avail an instant personal loan from MoneyGray without your salary slip and ITR but we will require your bank statement that contains details of your salary credits. Without this, we will not be able to approve your loan request.

9. Do I Need To Provide Any Security, Collateral Or Guarantors?

Ans: No, applicants do not have to provide security, collateral, or guarantors as MoneyGray personal loans are unsecured loans.